Blog

- Finance

- IPO

- Mergers & Acquisitions

- Turnaround

- • January 3 2020

Why Now Is The Time To Sell Your Business?

As an entrepreneur, selling your business can be as much of an emotional decision as it is a financial one. Plenty of considerations can and should go into it, rather than just the size of the cheque being cut by prospective buyers. However, in this practice, timing is a crucial aspect too. While pulling the […]

Read More- Finance

- IPO

- Mergers & Acquisitions

- Turnaround

- • December 16 2019

The 5 Pitfalls of Business Broker Valuations

1. Is this what you want to hear or what you need to hear? M&A literature is full of articles noting that valuations are ‘more art than science.’ Reading between the lines, this means that brokers will all value the same company differently. More pertinently for business owners, it can mean that the broker’s valuation […]

Read More- Finance

- IPO

- Mergers & Acquisitions

- Turnaround

- • October 30 2019

How to Choose the Right Buyer to Protect Your Company’s Legacy?

Most entrepreneurs are focused on growth and understandably so. However, when it comes time to exit, having a viable exit plan is just as critical as any growth plan. This exit plan takes on a heightened level of importance when selling to an external buyer. In a lot of cases, the entrepreneur has spent years […]

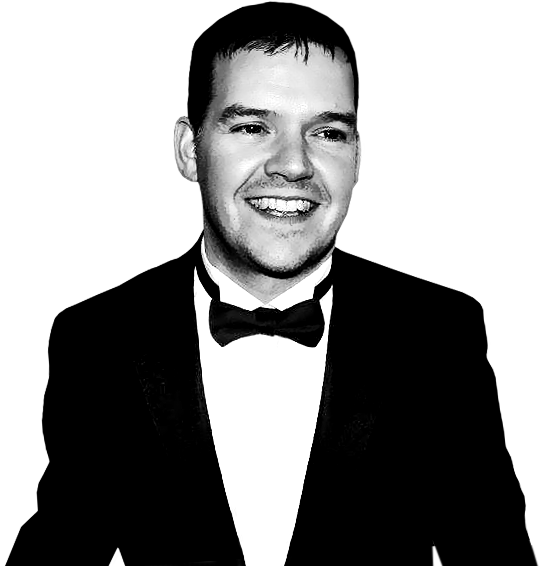

Read MoreLee Smith of UK mergers and acquisitions firm Verdani Investments is proud to have received the coveted 2019 award for mergers and acquisitions. Lee received this award for his m&a work in the IT sector where he grew revenues by 520% and profits by 400% in the space of nine months. When asked about the […]

Read More- Finance

- IPO

- Mergers & Acquisitions

- Turnaround

- • October 11 2018

Mergers and Acquisitions – The Time For Collaboration and Partnerships

In the world of mergers and acquisitions (M&A), there are an increasing number of stories, where organisations obtain a perceived unfair advantage or monopoly over their competition by using creative M&A strategies that the Competition Commission couldn’t stop. Therefore, With large businesses and corporations gaining ever more control over sectors, I believe the time is […]

Read MoreFunding an IPO can be a very expensive experience and you have to jump through many hoops with banks or lenders and end up with a large amount of debt, but there is another way with our IPO funding facility. If your business qualifies, we may be able to offer you IPO funding, which means […]

Read MoreCVA finance can provide the lifeline your business needs to get back to its full potential. Being in a CVA can make suppliers and potential clients nervous as your rating drops the minute you enter a CVA (Company Voluntary Agreement). There are alternatives to going into a CVA altogether, but most accountants and Insolvency Practitioners […]

Read MoreLee offers financial help for small businesses, without the stress and hassle that high street banks give you. In most cases, personal guarantees are not required and you wont have to secure finance against your house or family assets, which will come as a huge relief for business owners. Lee has experience in helping business […]

Read More- Finance

- IPO

- Mergers & Acquisitions

- Turnaround

- • May 22 2017

Turnaround Services For Your Business To Succeed

Our turnaround services offer a real chance for your business to not only survive, but thrive for many years to come. A successful turnaround requires commitment, flexibility and above all it requires all parties to agree and work together for the good of the company. Our turnaround services provide new processes and simple ways to […]

Read MoreA business turnaround specialist is a professional person that can provide insight into your business and can also bring valuable skills, tips and tools, that owners themselves would not otherwise have access to. A specialist also brings a unique viewpoint, usually because owners of small companies under £5m in revenues, are typically working in the […]

Read More

Recent Comments