Month: May 2017

IPO Funding

Posted on Funding an IPO can be a very expensive experience and you have to jump through many hoops with banks or lenders and end up with a large amount of debt, but there is another way with our IPO funding facility.

If your business qualifies, we may be able to offer you IPO funding, which means no upfront fees for the listing process and only a small monthly payment going forward. Being a PLC has many benefits, not only a substantial route to wealth, so take the pain out of the process and let us help you avoid getting into debt to gain access to the wealth of opportunity an IPO provides.

Our IPO funding option gives you exactly what you want, a public listing, just with a smarter model.

Contact Lee to find out more.

CVA Finance To Help Your Business

Posted on CVA finance can provide the lifeline your business needs to get back to its full potential. Being in a CVA can make suppliers and potential clients nervous as your rating drops the minute you enter a CVA (Company Voluntary Agreement).

There are alternatives to going into a CVA altogether, but most accountants and Insolvency Practitioners will recommend a CVA because they make good money from it.

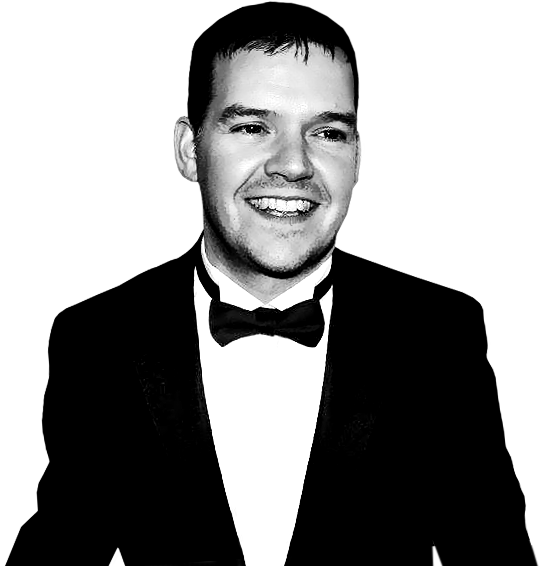

Lee can help you with either CVA finance or by not getting into a CVA in the first place, which is the best scenario. Lee prefers to work on a success basis so he wont take any fees from a CVA, which pits him on the same side as you, so there is trust from the start.

CVA finance will get you out of debt quickly and will get you back on track to the road to wealth.

Contact Lee now to see how he can help with your business.

Financial Help for Small Businesses

Posted on Lee offers financial help for small businesses, without the stress and hassle that high street banks give you. In most cases, personal guarantees are not required and you wont have to secure finance against your house or family assets, which will come as a huge relief for business owners. Lee has experience in helping business owners to keep their business running, realise the potential and provide an exit strategy that meets the needs of the shareholders.

Lee works on a success fee basis, so there isn’t and added financial pressure on the business.

Contact Lee now to discuss the options available.

Our turnaround services offer a real chance for your business to not only survive, but thrive for many years to come. A successful turnaround requires commitment, flexibility and above all it requires all parties to agree and work together for the good of the company.

Our turnaround services provide new processes and simple ways to manage cash flow so everyone can see clearly what is happening in the business. Our focus is on improving the profitability of the business and having a clear exit strategy for the business from the outset. This doesn’t mean that the business needs to be sold, but it does give a clear direction and focus on specific targets and goals, which is key for any business to succeed.

As well as focus on cash flow and profitability, we also like to have a plan on mergers and acquisitions, to see if a business in similar or vertical markets could be a good fit and add strengths to the existing business. This can be useful in many ways, one of these is cross-selling services and products to each others customer bases.

There is no one-size-fits-all solution with us, we will look at your unique situation and plan a strategy with you, as business partners, to ensure the best outcome possible and most of all, we don’t charge fees, we work on a success-only basis.

Contact Lee for more information

A business turnaround specialist is a professional person that can provide insight into your business and can also bring valuable skills, tips and tools, that owners themselves would not otherwise have access to. A specialist also brings a unique viewpoint, usually because owners of small companies under £5m in revenues, are typically working in the business, as opposed to working on the business.

In many small businesses, it is far easier for an experienced turnaround specialist to see what is required, as they have an external perspective and are not clouded by emotions and linked to the day to day stresses of managing cash flow, debtors, creditors, staff and customers.

Far too often, a business owner can be reluctant to change and doing things in a different way, although change can be exactly what is required, to not only save the business, but make it thrive for years to come.

How to Choose a Turnaround Specialist

Any reputable turnaround specialist should be able to provide solid case studies and examples of results achieved for other businesses. Just like in any other profession, you need to choose wisely and as long as there are references available, or you can see results achieved before, you should be in a safer pair of hands and ensure you get an agreement outlining some expected deliverables, so everyone knows what is expected of them.

How Long Does a Turnaround Take?

In some cases, a turnaround can take as little as 1-3 months, but each business is different and requires a unique approach. To make it the best success possible, a turnaround requires flexibility, a willingness to maybe do things differently and a partnership between the owner(s) and the turnaround specialist, as they are working on the same side as you and should act in an impartial way and offer experience and insight, that even your accountant and financial advisers cannot bring to the table.

How Much Does a Turnaround Specialist Cost?

There are different ways to work with a turnaround specialist, some will want to charge daily fees, however I prefer to work on a success basis, where I only get paid for results, as I think this is the fairest way for all parties. In this scenario, everyone wins when the results are produced, which I think is critical for the business owner(s) as they need people that are on their side and championing their cause. This also ensures that owners can have full trust and confidence that the specialist is spending his time doing things that will help you and not simply racking up the hours, to collect fees, that may just be causing more pain to the business and adding to any existing cash flow issues.

Where Can You Find Turnaround Specialists?

A good place to start is LinkedIn. Try searching for business turnaround specialist and then interview prospective partners, to see who is best aligned to your needs and goals.

Lee Antony Smith is an experienced, UK-based, business turnaround specialist, with 4 years’ mergers and acquisitions experience. Working with small and medium-sized businesses in a variety of sectors, Lee has taken companies from a state of near closure to sale in the space of 12 months.

Contact me for more information.

Recent Comments